— Get the Facts —

Composite Plans Work

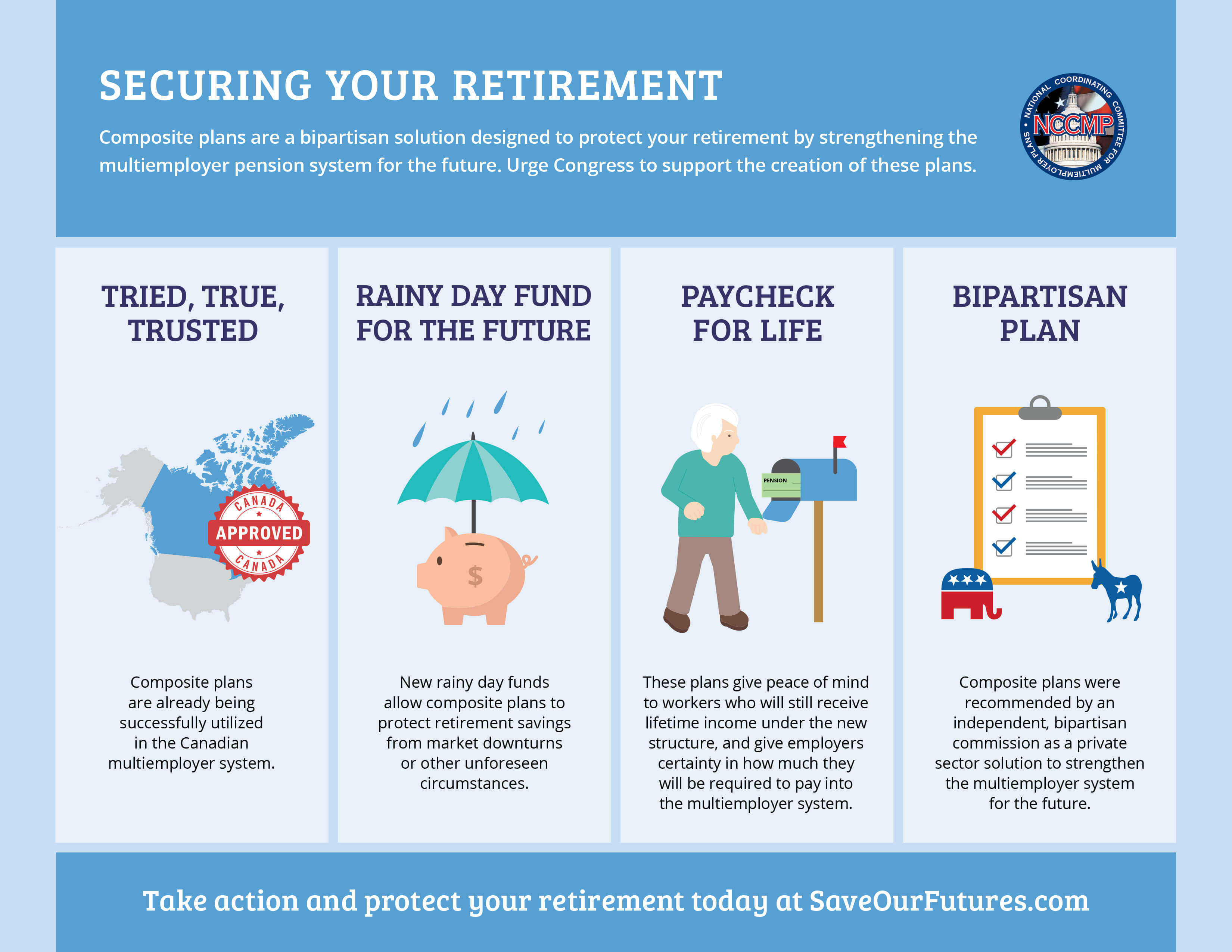

The GROW Act allows for a new type of multiemployer pension plan called a composite plan. Composite plans protect existing pensions while offering greater stability to employers and certainty to working Americans. Allowing for composite plans will strengthen the multiemployer pension system and allow it to keep pace with changes in the economy.

Composite plans work because they:

Offer greater retirement stability to workers.

The composite plan proposal would provide more certainty for an employer’s contribution rate, provide for better management of a plan’s assets versus its liabilities, and ultimately achieve greater retirement certainty for workers who are currently contributing to the multiemployer system.

Delivers a bipartisan solution to a looming issue for millions of Americans.

The composite plan proposal was recommended by an independent, bipartisan commission as a solution to strengthen the multiemployer system for the future.

Provide an alternative to defined contribution with a 120% target funded ratio.

Composite plans are not a replacement for healthy defined benefit plans. Instead, they are designed to be an alternative to the 401(k)/defined contribution plans that are increasingly proposed when an employer can no longer assume the financial responsibilities of a defined benefit plan. Participating pension plans would be required to maintain a target funded ratio (assets over liabilities) of 120%. Plans failing to meet this target would be required to take corrective action.